Commercial Property Investment in Japan Implodes 57 Percent Annually in Late 2023

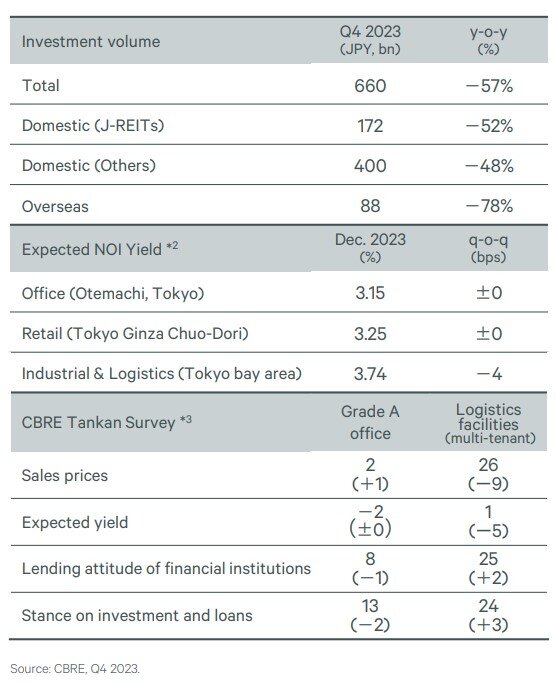

Based on new data by CBRE, commercial real estate investment volume in Japan fell by 57% year-over-year to JPY 660.0 billion in Q4 2023.

Based on new data by CBRE, commercial real estate investment volume in Japan fell by 57% year-over-year to JPY 660.0 billion in Q4 2023. While this was largely a product of the high base registered in Q4 2022, during which Otemachi Place changed hands for JPY 440.0 billion, it was also due to a 78% y-o-y decline in foreign investment, with overseas investors maintaining the cautious attitude they have adopted since mid-2023.

By asset type, CBRE says the most significant increase this quarter was seen in the residential sector, for which investment volume surged by 50% y-o-y to JPY 187.0 billion. The acquisition of a 20-property portfolio by a J-REIT for a total of JPY 46.9 billion contributed significantly. The retail sector also recorded a strong increase in investment volume, which rose by 48% y-o-y to JPY 115.0 billion.

Full-year 2023 investment volume was down by 3% from 2022, predominantly due to a 28% slide in foreign investment. By asset type, office transaction volume recorded the largest decline, falling by 43%.

According to the results of CBRE's latest survey of investors in Japan, the percentage of investors planning to increase their acquisition volume in 2024 was down 6 pp. from the previous year's survey, while those planning to increase sales volume were up by 9 pp. This suggests a weaker purchasing appetite among investors.

What's Your Reaction?