Commercial Property Investment in Japan to Weaken in 2024

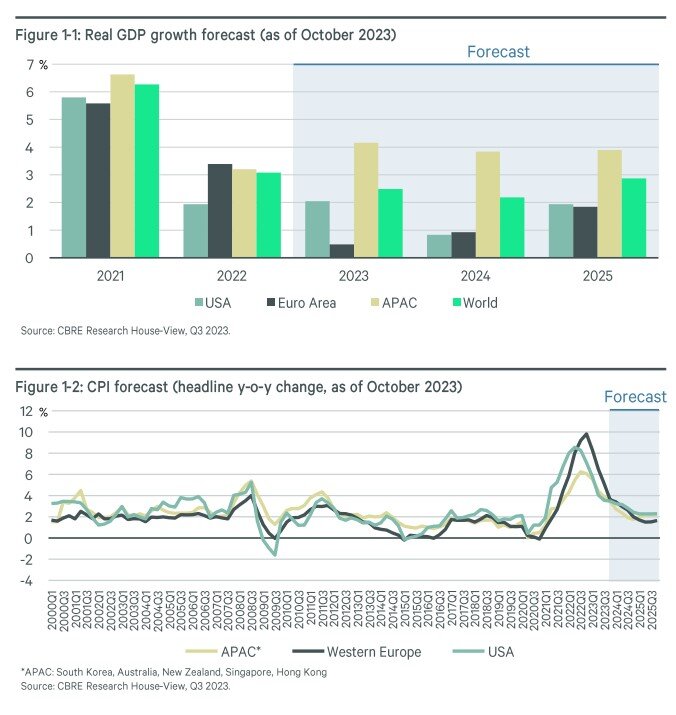

According to new data from CBRE, consensus forecasts expect the Japanese economy to continue to see moderate growth of around 1% per annum in 2024 and beyond. Capital expenditure is projected to increase on the back of generally strong corporate earnings.

According to new data from CBRE, consensus forecasts expect the Japanese economy to continue to see moderate growth of around 1% per annum in 2024 and beyond. Capital expenditure is projected to increase on the back of generally strong corporate earnings. The semiconductor and automotive industries are expected to underpin exports, while inbound tourist spending is set to grow further, propelled by the return of Chinese visitors. However, domestic consumption may shrink as consumers tighten purse strings in response to falling real wages.

The Bank of Japan has indicated that it will closely monitor wage growth to see whether it will keep pace with inflation, with the results of the spring labor negotiations ("Shunto") set to inform the BoJ's policy decisions in 2024.

Commercial Property Investment

Thanks to robust spending by domestic investors, Japan commercial real estate investment volume in 2023 is projected to exceed that of the previous year. However, investment is likely to weaken in 2024 as investors adopt a more selective approach in response to the changing supply-demand balance in the rental market. Other headwinds include a possible shift in the BoJ's monetary policy leading to further increase in long-term interest rates, which may push up investors' targeted cap rates, potentially inhibiting the flow of transactions and further weighing on investment volume.

Office Market

CBRE says that in a continuation of the trend that emerged in the previous year, 2023 saw vacancies filled by companies moving to new premises in superior locations or higher-grade buildings. Most cities where the vacancy rate rose saw significant new supply come on stream at less than full occupancy. Amid the ongoing drive among companies to improve their working environment, demand for office space should continue to recover in 2024. In cities where new supply will exceed what the market can absorb, however, rents are likely to continue to fall as the vacancy rate rises.

Logistics

Total net absorption across Japan's four major metropolitan areas in 2023 is set to top 1 million tsubo for the first time since records began. Demand for logistics facilities continues to grow on the back of concerns over the "2024 problem" and a strengthening of manufacturing supply chains. Even though new supply is slated to remain abundant, vacancy rates should remain stable or even fall slightly in all major cities, according to CBRE.

Retail

While strong demand for store space on the Ginza high street is still seen from a wide variety of retailers, available properties in the prime locations are becoming scarce. On the back of such a tight supply-demand balance, Ginza high street rents recorded a 7.9% year-over-year rise in Q3 2023, returning to pre-pandemic levels. CBRE projects rents will continue to climb steadily going forward, says CBRE.

What's Your Reaction?