California Home Sales Uptick 6 Percent Annually in January

Based on new data from the California Association of Realtors, the State of California existing home sales rebounded in January 2024 to the highest level in six months as mortgage rates pulled back sharply at the end of 2023.

Based on new data from the California Association of Realtors, the State of California existing home sales rebounded in January 2024 to the highest level in six months as mortgage rates pulled back sharply at the end of 2023.

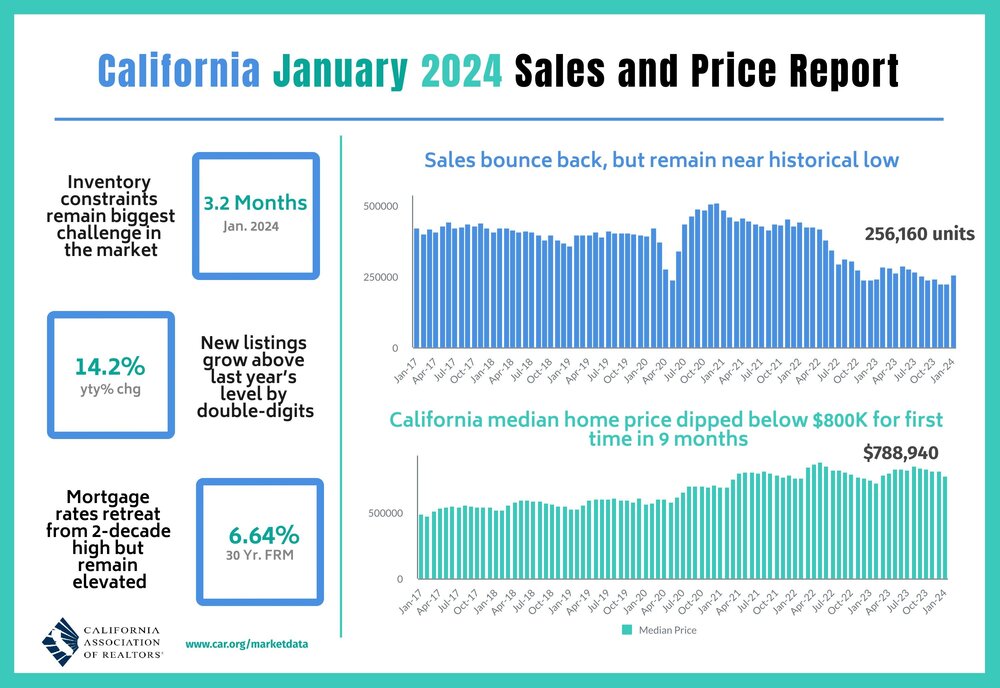

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 256,160 in January, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2024 if sales maintained the January pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

January's sales pace climbed 14.4 percent higher from the revised 224,000 homes sold in December and was down 5.9 percent from a year ago, when a revised 241,920 homes were sold on an annualized basis. While the increase in January was the first year-over-year sales gain in 31 months, the sales pace stayed below the 300,000-unit threshold for the 16th straight month and will likely stay below that level in the first quarter of 2024. With interest rates moderating sharply at the end of 2023 and leveling off nearly 100 basis points below the most recent peak, home sales should continue to grow year-over-year in February, but the improvement will be modest.

"It's encouraging to see California's housing market kick off the year with positive sales growth in January," said C.A.R. President Melanie Barker. "While we'll likely experience some ups and downs in home sales in the coming months as rates continue to fluctuate, the lending environment is expected to be more favorable in 2024, so the market should see more pent-up demand translate into sales."

While California's statewide median home price decreased 3.8 percent from December's $819,740 to $788,940 in January, it registered a 5.0 year-over-year gain, the seventh straight month of annual price gains. The monthly price decline was due primarily to seasonal factors, and the January figure marked the first time in ten months that the median price dropped below the $800,000 benchmark. With mortgage rates softening since mid-October, home prices will likely maintain their upward momentum, and the market should continue to observe a mid- to single-digit, year-over-year growth rate in California's median price in at least the early part of 2024.

"The increase in new active listings for the first time in 19 months was great news for the California housing market," said C.A.R. Senior Vice President and Chief Economist Jordan Levine. "With rates climbing back up to a two-month high earlier this week due to the latest inflation concerns, potential home sellers could hit the pause button on listing their house on the market and wait until rates begin to ease again. In general, rates are expected to decline later this year, and available inventory should slowly improve throughout 2024."

Other key points from C.A.R.'s January 2024 resale housing report include:

- At the regional level, sales in all major regions rose in January on a year-over-year basis, with the Central Valley region recording the largest increase of 12.5 percent from a year ago. The Far North (6.8 percent), San Francisco Bay Area (6.2 percent) and Central Coast (5.2 percent) were the other major regions posting modest sales growth of 5 percent or more from the prior year. Southern California (2.2 percent) also registered an increase from a year ago, but at a more moderate pace.

- Fourteen of the 52 counties tracked by C.A.R. registered a sales decline from a year ago, with 7 counties dropping more than 10 percent year-over-year and four counties falling more than 20 percent from last January. Mono (-50.0 percent) registered the biggest sales dip, followed by Trinity (-33.3 percent) and Glenn (-25.0 percent). Thirty-six counties logged a sales increase from last year, with Siskiyou (72.7 percent) gaining the most year-over-year, followed by San Benito (66.7 percent) and Tuolumne (62.2 percent).

- At the regional level, all but one major region recorded an annual increase in their median prices. The San Francisco Bay Area posted a 10.6 percent year-over-year jump. The median price in Southern California (7.0 percent), Central Valley (6.8 percent) and the Central Coast (3.5 percent) also jumped from a year ago in January, but the growth was more moderate. The Far North (-2.0 percent) was the only region of the state to record a price decline when compared to January 2023, with three of its seven counties posting price drops from a year ago.

- Home prices continued to show year-over-year improvement in many counties, with 41 counties across the state registering a median price higher than what was recorded a year ago. Santa Barbara (43.8 percent) registered the biggest price increase in January, followed by Mendocino (27.0 percent) and Marin (26.9 percent). Nine counties logged median price decreases from last year, with Siskiyou dropping the most at -14.7 percent, followed by Lassen (-11.9 percent) and Glenn (-11.1 percent).

- Unsold inventory statewide increased 28 percent on a month-over-month basis and declined from January 2023 by -8.6 percent. The Unsold Inventory Index (UII), which measures the number of months needed to sell the supply of homes on the market at the current sales rate declined from 2.5 months in December to 3.2 months in January. The index was 3.5 months in January 2023.

- Active listings at the state level dipped again on a year-over year basis for the 10th straight month in January, but the decline was the smallest ― a sign that active listings might be heading in the right direction as the market approaches the spring homebuying season. That said, while the reprieve in mortgage rates might have provided some hope that more for-sale properties would be listed as we kick off the new year, the jump in mortgage rates in the past couple of weeks could cause potential sellers to reconsider listing their homes for sale.

- Active listings declined from a year-ago in 35 counties in January, with 17 of them registering a double-digit decrease at the beginning of this year. Contra Costa had the biggest year-over-year dip at -36.0 percent, followed by Mono (-33.3 percent) and Santa Clara (-31.8 percent).Sixteen counties recorded a year-over-year gain, with El Dorado jumping the most with an increase of 32.0 percent from a year ago, followed by Santa Barbara (31.6 percent) and Nevada (28.9 percent).On a month-to-month basis, 34 counties recorded a drop in active listings last month while 18 counties recorded a monthly increase in for-sale properties in January with active listings in Shasta (143.6 percent) more than doubled.

- New active listings at the state level increased from a year ago for the first time in 19 months, and the annual increase was the largest since May 2022. The jump in new active listings contributed to an improvement in overall active listings, and the sharp drop-in rates at the end of 2023 was likely the motivating factor that convinced more homeowners to sell their homes.

- The median number of days it took to sell a California single-family home was 32 days in January and 39 days in January 2023.

- C.A.R.'s statewide sales-price-to-list-price ratio* was 98.9 percent in January 2023 and 96.5 percent in January 2023.

- The statewide average price per square foot** for an existing single-family home was $386, up from $370 in January a year ago.

- The 30-year, fixed-mortgage interest rate averaged 6.64 percent in January, up from 6.27 percent in January 2023, according to C.A.R.'s calculations based on Freddie Mac's weekly mortgage survey data.

What's Your Reaction?