Office Landlords Nationwide Increasing Concessions to Lure Tenants in U.S.

According to a new report from CBRE, office-building owners across the U.S. are granting more concessions, such as months of free rent and larger tenant-improvement allowances, to entice companies into their buildings amid a challenging office market and slowing economic growth.

U.S. office vacancies will peak at 19.8 percent in late 2024

According to a new report from CBRE, office-building owners across the U.S. are granting more concessions, such as months of free rent and larger tenant-improvement allowances, to entice companies into their buildings amid a challenging office market and slowing economic growth.

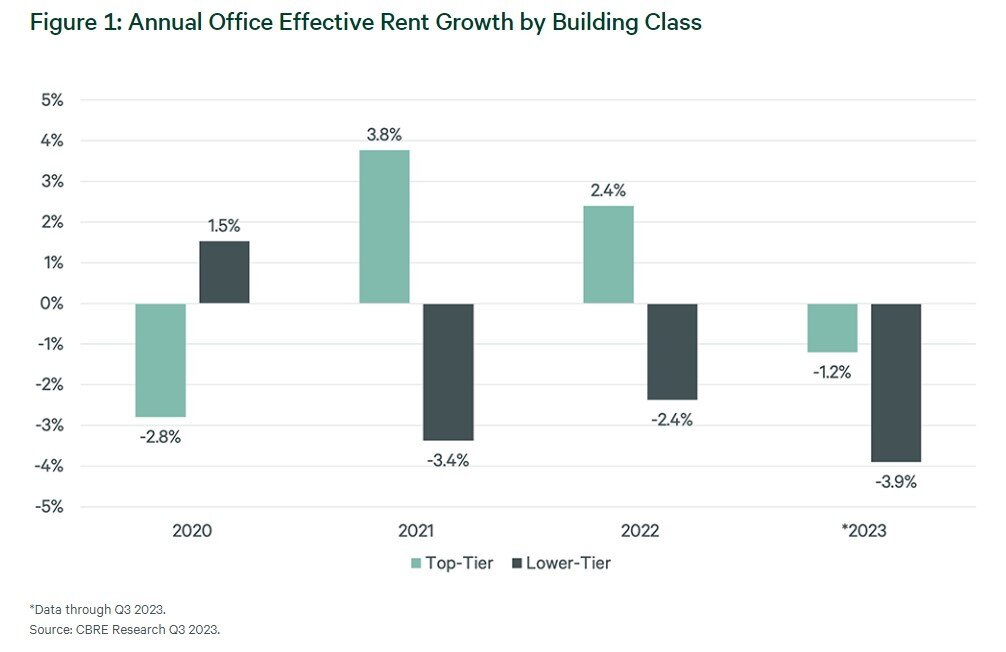

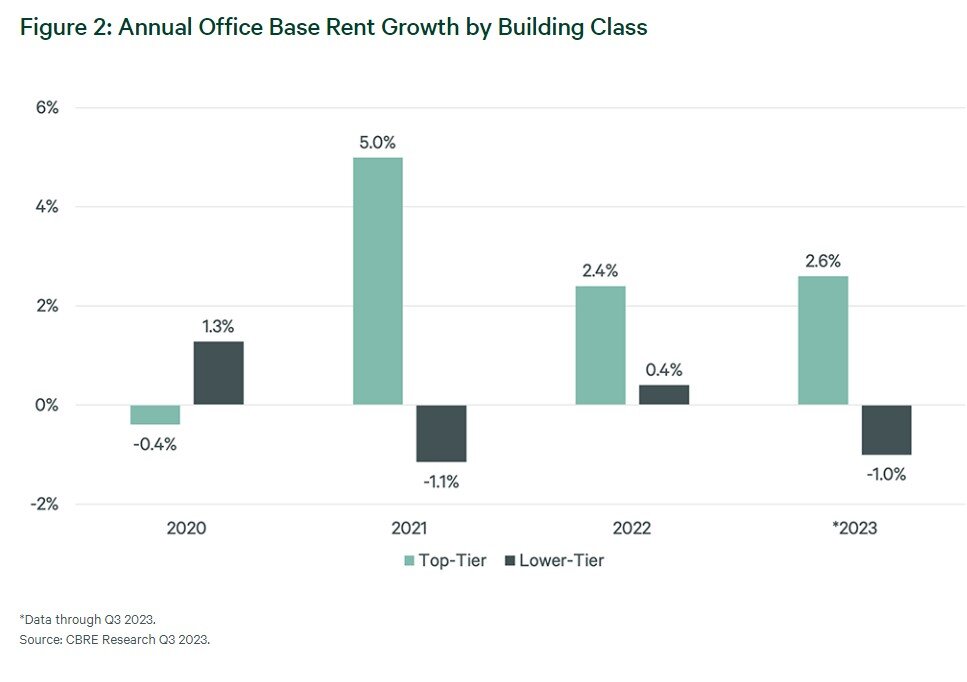

CBRE's analysis of 3,400 lease transactions across 12 major U.S. cities* found that effective rents declined by 1.2% in top-tier buildings since 2022. The decline was greater for lower-tier buildings: 3.9%. As a measure, effective rent accounts for the cost to building owners of concessions, making it a more comprehensive gauge than the higher asking rents that owners advertise in the market.

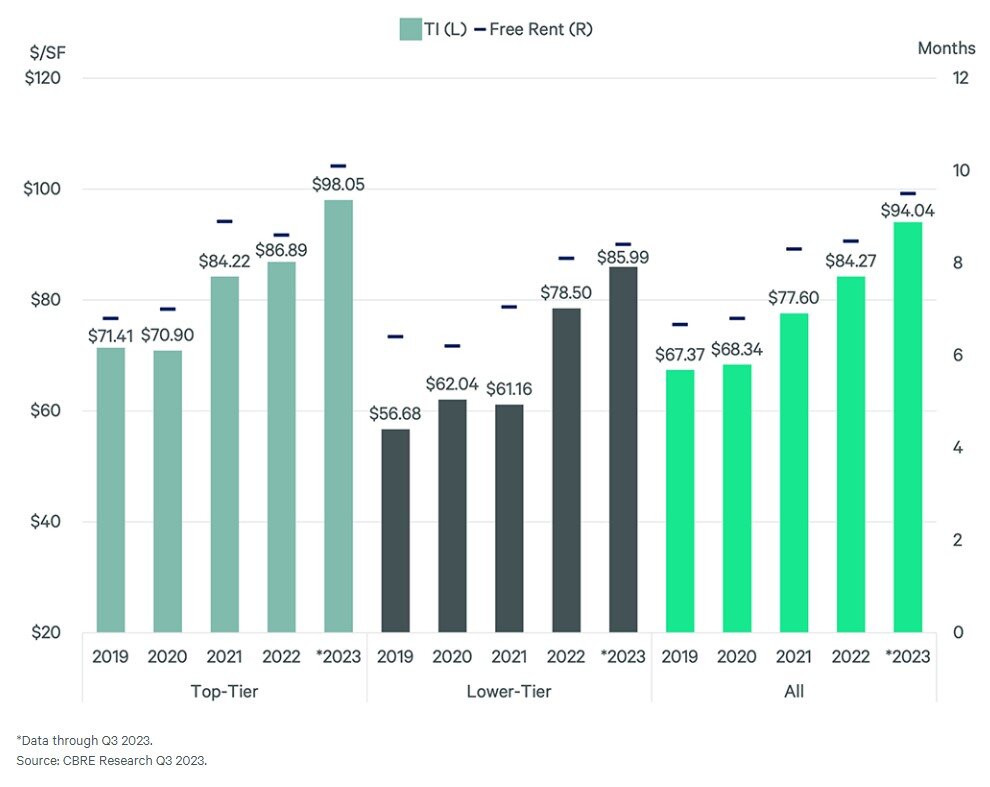

To that end, concessions have reached highs this year. The average duration of free rent provided in top-tier buildings upon lease signing reached 10.1 months this year, up from 6.8 months in 2019. In lower-tier buildings, the average this year is 8.4 months, up from 6.4 in 2019.

The trend is similar in tenant-improvement allowances, which is money provided by the building owner for tenants to use in building out their space to their needs. Those allowances have risen by 37% to $98.05 per sq. ft. in top-tier buildings since 2019 and by 52% to $85.99 per sq. ft. in lower-tier buildings. Some of those increases can be attributed to higher construction costs.

While concession averages appear larger for top-tier buildings, they're more significant for lower-tier buildings because the latter command lower base rents.

"The increase in concessions underscores just how office tenants have an advantage in lease negotiations today," said Mike Watts, CBRE President of Americas Investor Leasing. "It also illustrates an ongoing 'flight to quality' in which companies favor higher quality buildings that will help to entice employees to work from the office. In turn, lower-tier properties have needed to boost concessions to stay competitive in leasing."

Higher financing costs and tight lending conditions likely will spur owners to offer tenants less costly concessions in 2024, such as free access to shared building services like communal conference rooms. That could also include more flexible lease terms, such as options to expand or contract their office square footage at earlier or more frequently during the lease term.

U.S. office vacancy registered 18.4% in this year's third quarter, up from 12.1% in 2019. CBRE forecasts that vacancy will peak at 19.8% in 2024.

What's Your Reaction?